Sample of filling out form 3 personal income tax with explanation. Samples and examples of filling. In what cases should it be taken?

How to fill out deductions in the 3-NDFL declaration? This article, as well as a selection of materials from our website, will help answer this question. Filling out tax deductions in 3-NDFL occurs according to special algorithms, taking into account the conditions established by the Tax Code of the Russian Federation for their application. Let's consider the algorithm for filling out the 3-NDFL declaration for deductions.

What are tax deductions in the 3-NDFL declaration, why are they needed and who can claim them

For the purposes of filling out 3-NDFL, a tax deduction is usually understood as a decrease in the income received by an individual or individual entrepreneur, on which income tax is paid. The same term denotes the return of previously paid personal income tax in situations provided for by the Tax Code of the Russian Federation (in connection with the purchase of property, expenses for training, treatment, etc.).

A person who:

- is a citizen of the Russian Federation;

- has income subject to personal income tax (13%).

Deductions allow you to reduce the tax burden on an individual (reduce income tax payable or return part of previously paid personal income tax).

The Tax Code provides for 5 types of deductions:

- standard (Article 218 of the Tax Code of the Russian Federation);

- property (Article 220 of the Tax Code of the Russian Federation);

- social (Article 219 of the Tax Code of the Russian Federation);

- professional (Article 221 of the Tax Code of the Russian Federation);

- associated with the transfer of losses from transactions of individuals with securities (Article 220.1 of the Tax Code of the Russian Federation).

For current changes in the legislation on tax deductions for personal income tax, see the heading of the same name "Tax deductions for personal income tax in 2018-2019"

Each deduction has its own characteristics and can only be applied taking into account the conditions specified in the Tax Code of the Russian Federation. Next, we will tell you how to fill out certain types of deductions in the 3-NDFL declaration.

NOTE! The declaration for 2018 must be submitted using the new form from the Federal Tax Service order dated October 3, 2018 No. ММВ-7-11/569@. You can download the form.

How to fill out standard deductions in 3-NDFL

Standard tax deductions are provided to certain categories of individuals (“Chernobyl survivors”, disabled people since childhood, parents and guardians depending on the number of children, etc.).

Find out more about standard deductions.

In 3-NDFL, information about standard deductions is provided from the data in the 2-NDFL certificate and is necessary for the correct calculation of the amount of personal income tax (its refundable part or paid to the budget).

Let's look at filling out information in 3-NDFL about standard tax deductions using an example.

Example 1

Stepanov Ivan Andreevich bought an apartment in 2018 and decided to return part of the personal income tax. To do this, he filled out 3-NDFL using the “Declaration 2018” program posted on the Federal Tax Service website.

To enter information into 3-NDFL after filling out the initial data (about the type of declaration, the Federal Tax Service code, personal data and other mandatory information), in the “Deductions” section, I. A. Stepanov ticked the following boxes:

- “provide standard deductions”;

- “there is neither 104 nor 105 deduction” (which means that Stepanov I.A. has no right to a deduction of 500 or 3,000 rubles per month provided to the categories of persons specified in paragraph 1 of Article 218 of the Tax Code of the Russian Federation);

- “the number of children per year did not change and amounted to” - from the list Stepanov I.A. chose the number “1”, which means that he has an only child.

For the Ministry of Finance’s opinion on “children’s” deductions, see the message “Child from a first marriage + child of a spouse + common: how many deductions is an employee entitled to?” .

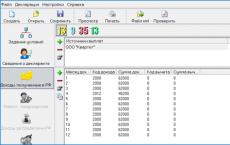

What the “Deductions” section looks like after filling out, see the figure:

In order for the program to calculate the amount of standard deductions and generate the necessary sheets in 3-NDFL, Stepanov filled out another section - “Income received in the Russian Federation” - as follows:

As a result of filling out these sections in the declaration by the program, Appendix 5 was formedwith information on the total amount of standard tax deductions provided to Stepanov I.A. at his place of work. The program calculated the total amount of deductions taking into account the limit established by the Tax Code of the Russian Federation on the amount of income within which standard “children’s” deductions are provided.

Fragment of completed application 5For information on the total amount of standard deductions and the number of months of their provision, see below:

Explanation of information in Appendix 5:

- deductions for 1 child in the amount of 7,000 rubles. (RUB 1,400/month × 5 months);

- deductions are provided for 5 months. — the period from January to May 2018 (until the cumulative income from the beginning of the year did not exceed 350,000 rubles).

The article will tell you about the nuances of registering 3-NDFL “Sample of filling out tax return 3-NDFL” .

Reflection of social deductions in 3-NDFL (together with standard deductions)

The Tax Code of the Russian Federation provides for 5 types of social tax deductions (see diagram):

Let's change the conditions of the example (while maintaining the data on income and standard deductions entered into the program) described in the previous section to clarify the rules for filling out social deductions in 3-NDFL.

Example 2

Stepanov I.A. paid for his advanced training courses in 2018 in the amount of 45,000 rubles. In the 3-NDFL declaration, he declared his right to a personal income tax refund in the amount of 5,850 rubles. (RUB 45,000 × 13%).

To reflect the social deduction in 3-NDFL, Stepanov I.A. filled out the “Deductions” section in the following order:

- checked the box “Provide social tax deductions”;

- in the subsection “Amounts spent on your training” indicated the amount of 45,000 rubles;

- I left the remaining fields blank.

After entering the data, the completed “Deductions” section in the program began to look like this:

Dedicated to social and standard deductions, Appendix 5 of the 3-NDFL declaration began to look like this (reflecting the amount of standard and tax deductions):

For new tax deduction codes, see the article “Tax deduction codes for personal income tax - table for 2018 - 2019” .

Nuances of using the right to deduction (year of start of use, deductions for previous years, where 3-NDFL with deductions is submitted)

An individual wishing to use his right to deduction must take into account that:

1. For 2018, 3-NDFL is submitted in the form approved by Order of the Federal Tax Service dated October 3, 2018 No. ММВ-7-11/569@. You can download the form.

2. The year in which the deduction began to be used is the year for which the personal income tax was first returned.

3. The need for deductions for previous years may arise if an individual returns personal income tax for several years (for example, when buying a home in installments) or the individual learned about his right to a deduction later than the period of obtaining the right to it.

Cm. “Tax deduction when buying an apartment with a mortgage (nuances)” .

4. Separate tax deductions can be obtained both from the tax office and from your employer. In the first case, 3-NDFL must be submitted to the inspectorate at the place of residence.

Results

A tax deduction in the 3-NDFL declaration is reflected if the taxpayer has income taxed at a rate of 13% and he belongs to the categories of persons specified in the Tax Code of the Russian Federation who are entitled to receive a deduction.

Deductions in 3-NDFL are reflected on special sheets depending on the type (standard, social, property, etc.). A program posted on the Federal Tax Service website will help you fill out the declaration without errors, identifying errors and calculating the tax to be refunded or paid.

The Tax Code is a legislative act that regulates the taxation process. All income of a person participates in this process. This allows you to replenish the budget, as well as organize the normal functioning of the state.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

The declaration must be drawn up after the relevant reporting period has ended. There are limited deadlines until April 30 when it comes to paying taxes. This rule applies to individual entrepreneurs equally.

But when returning parts of the tax paid earlier, there are no restrictions; you can submit information throughout the entire calendar year. The only thing is that only amounts spent over the previous three years are taken into account. If these deadlines are violated, then it is no longer possible to receive a deduction.

Fines

The minimum amount of fines for individuals is 1000 rubles. A penalty of 20 percent is applied to those who transferred less tax than required.

What should you consider?

Receiving tax deductions is the legal right of all citizens who regularly pay income taxes. Essentially, this is a return of funds spent earlier.

Deductions are divided into several groups:

- Standard. For persons raising children, as well as those entitled to receive benefits.

- Social. In the case of charity, receiving paid treatment or training.

- Property. Issued after purchasing real estate.

- Professional. In this case, an application for compensation is submitted by individual entrepreneurs.

3-NDFL is a certificate whose main functions are not limited to reporting. This certificate allows you to return part of the costs in the form of a lump sum payment, or as an increase in wages due to the fact that income tax is not withheld from wages for some time. To receive compensation, it is enough to submit a declaration along with the appropriate application.

The text of this article will be useful to those taxpayers who want to know how to fill out the property deduction for the 3rd year.

Download a sample 3-NDFL declaration form for property deduction for the 3rd yearIn order for the tax refund procedure for the purchase of real estate to be successful, we strongly recommend taking into account the rules for preparing a tax return, which will also be discussed.

- declarations for 2017.

- Form 3-NDFL to receive a deduction for the purchase of property.

- Special for filing a tax return.

As is known, compensation that is accrued to taxpayers who have invested material resources in the acquisition or construction of property assets is the largest in size compared to other types.

Since tax legislation has adopted a rule stating that an individual can return no more money in a year than he contributed to the state budget for income tax, the payment is usually extended over several years.

It should be noted that to receive all the funds accrued as a deduction for the purchase of property, submitting Form 3-NDFL once is not enough. The taxpayer should enter data into the declaration form every year, submit it for review to the tax service and thus gradually withdraw the property compensation due to him.

First pages of the declaration

Before indicating information related to the purchased housing or land plot, the taxpayer must enter information about his income, as well as display some information about himself. This is done using the first four sheets of the 3-NDFL form - the title, the first section, the second, as well as sheet A and/or B, the last of which is intended to be filled out by individuals receiving funds from foreign sources of profit.

Basically, however, they also contain several of the following meanings, which not all applicants for property deductions know how to work with:

Sheet D1

After the buyer of the property completes the main pages of the declaration, he will need to work with sheet D1. It is on this page of form 3-NDFL that you need to calculate property tax compensation and provide some general information. An individual will need to provide the following information:

- Code of the purchased property. Since you can get a deduction not only for a house or apartment, but also for other property objects, it is necessary to note what kind of real estate was purchased. If this is a house with a plot of land attached, then the code in this case is 7, if the apartment is 2.

- Sign of an applicant for deduction. In order to indicate how many owners own the property for which a tax discount has been applied for, as well as which of them applies for it, a taxpayer attribute code has been invented. Thus, if an individual who is the sole owner of the house wants to take advantage of the deduction, then he needs to write the numbers 01.

- Object data. Also, the taxpayer must indicate whether he owns the acquired property individually or whether the property is registered as a shared or joint property, write the full address where this property is located, and also indicate the date of registration of the right to the property and the date of filing for the distribution of property tax compensation.

- Various amounts. First of all, the buyer of the property is required to display the amount he spent on its purchase, and then the amount (this action is necessary if a loan was taken out). In addition, the size of the tax base is entered, from which property tax compensation has already been deducted, and the amount of costs recorded in documents is written down.

- Remaining deduction. Since we are talking about receiving property-type compensation for the third year, it is very important to correctly fill out the cell that implies indicating the residual tax credit. An individual needs to take the declaration for the previous year and subtract the amount of the deduction that will be provided to him for the current tax period from the balance recorded in it, and reflect the result obtained in line 230 of sheet D1.

How to get a tax refund on mortgage interest payments

Since a loan is a fairly popular service that makes the process of purchasing real estate quite easy, borrowers take advantage of this and charge individuals considerable interest.

However, it is also provided for in current legislation. Costs of this kind must be included in the corresponding lines of sheet D1 - 130 and 240.

The main thing is to keep separate records of expenses associated with the purchase of property and the payment of interest, and in no case add them up.

Thus, in paragraph 1.13 the amount that the deduction applicant has currently spent on paying off interest and has not received compensation for it is entered, and in paragraph 2.11 - the balance of the tax rebate due for interest expenses to the taxpayer in the future.

Important! All amounts declared by an individual in sheet D1 must be indicated on the basis of declarations for or be confirmed using other documentation of a settlement nature.

How to fill out 3-NDFL yourself? In this article we will look at the general rules for filling out a tax return. I think that after this you can easily prepare your own personal reporting.

Download the Declaration program

From the very beginning, you need to install the “Declaration” program for the year for which you are going to fill out the 3-NDFL form. If you want to receive tax deductions for 2019, in this case, download the program for this particular period.

If you need declarations for previous years, you will need to install several such programs. They all work on the same principle.

You can download the “Declaration” program from the tax service website: www.nalog.ru/rn77/program//5961249/

It is very easy to install, instructions are included on the website. We will talk to you about how this program can be used. In this article, we will look at the first two tabs, which we will learn how to fill out.

And this is what you and I will learn to do now. Those who, after watching the video, understand everything, can fill out their own declaration. 🙂

For those who want to know more details: where to get the data from and what fields need to be filled in, I suggest you continue reading this Instruction.

Tab Setting Conditions

Inspection number

Let's start with the “Set conditions” tab. In 99% of cases, you only need to fill in the tax office number.

The question often arises - where to get it from? This information is available on the website nalog.ru. You can also use other sites. For example, updated information is always available on the Federal Tax Service website: www.ifns.su/ADRESA/regions.html

First of all, you need to select a region. For example, we will select Moscow, this is the 77th region.

And then here you can select settlements that belong to this region. At the beginning there are various towns and cities. If you need an address directly in the city itself, then go below the street. And, accordingly, letters by which you can select the desired address.

This table shows OKATO codes, postal code, tax office code and OKTMO code. We will need these numbers in order to indicate them in the “Tax Declaration” program.

Since the list can be very long, you can use the standard search function in your browser. To do this, take the key combination Ctrl – F and type the beginning of the street name.

Some streets are highlighted in blue and you can follow this link to go inside.

This means that there are several houses on this street, and these houses have different, for example, indexes. As a rule, the tax inspectorate and all other codes are the same, but their indexes are different. In this case, you find your home, sometimes it happens that you need to select a building, a building, and then find the desired zip code specifically for your address.

Select the tax office code for your street and return to our program. After that, click on the button next to the window with the inscription “Inspection number”.

A long list of all existing inspections appears. You can simply scroll through it manually, or simply click on any line and type the code for our Federal Tax Service on the keyboard. After that, we select the tax office we need and click OK.

Correction number

What else is on this tab? Correction number. By default this will always be 0.

The figure here can only change if you file a corrective return. For example, you submitted a declaration for 2016, and the tax office accepted it. But after that, any errors were discovered or you found additional receipts and want to add some more information.

In this case, you make a corrective personal income tax return 3. It is compiled exactly the same as the original one. The only difference will be this sign. For example, 1 if you deal once. If you pass and correct the declaration again, then put 2.

Depending on how many times you redo your declaration, you will need to increase this attribute. Well, for the first filling we leave 0.

Taxpayer attribute

In the “Taxpayer Attribute” section, by default there is a dot for individuals. We leave her.

Well, unless, of course, you are engaged in entrepreneurial activity, but are submitting 3-NDFL as a simple physical. face.

Income available

Income, as a rule, is taken into account only by certificates of income of individuals, that is, 2-NDFL. All other checkboxes can be left unchecked. In exceptional cases, if you receive income in foreign currency, participate in investment partnerships, or are engaged in entrepreneurial activities, then these boxes should be ticked.

Reliability is confirmed

One more nuance: if you plan to submit your declaration in person, then you don’t need to change anything. We leave the default point next to “Personally”.

If you issue a power of attorney to some other individual who will do this instead of you, then such a power of attorney, firstly, must be notarized. Secondly, it will be necessary to change the conditions. In this case, you need to write the data of that physical. the person who will submit your declaration for you.

Tab Information about the declarant

Let's move on to the next tab. Please note that this tab has 2 sub-tabs: personal data and address. Let's take a closer look at each of them

Personal Information

First, we enter personal data: last name, first name, patronymic. Also TIN, place and date of birth.

I think there is no point in talking about this in detail. I hope that every person can do this on their own. 🙂

In most cases, a passport is selected here: code 21, passport of a citizen of the Russian Federation.

In exceptional situations, if you have some other document confirming your identity, then choose from the list what you need.

Address

If you need personal advice or assistance in completing the 3-NDFL declaration, then feel free to visit our website “Tax-simple!” We work quickly and with pleasure!

Good luck with your declaration! We love tax returns.

In this section we will provide examples of filling out the 3-NDFL declaration for various situations. All filling samples are available for download in .pdf format.

You can also fill out the 3-NDFL declaration directly on our website in 15-20 minutes by answering simple questions: Fill out 3-NDFL online.

Sample of filling out the 3-NDFL declaration for 2016 when selling an apartment

Example description: In 2016, Ivanov I.I. sold an apartment that he owned for less than three years for 1 million rubles. The entire cost of selling the apartment was covered by the standard deduction upon sale (max. 1 million rubles). Accordingly, according to the results of the declaration, Ivanov I.I. does not have to pay income tax.

Sample of filling out the 3-NDFL declaration for 2016 when selling a car

Example description: In 2016, Ivanov I.I. sold the car, which I owned for less than three years, for 500 thousand rubles. Ivanov I.I. there were documents confirming the purchase of the car for 400 thousand rubles. Accordingly, according to the results of the declaration, Ivanov I.I. must pay income tax in the amount of 100 thousand rubles. x 13% = 13 thousand rubles.

Sample of filling out the 3-NDFL declaration for 2016 for a tax deduction when buying an apartment

Example description: In 2016, Ivanov I.I. bought an apartment worth 2 million rubles. In the same year Ivanov I.I. worked at Tulip LLC, where his annual income amounted to 3 million rubles. (390 thousand rubles of income tax were paid). Based on the results of the declaration, Ivanov I.I. 260 thousand rubles must be returned from the budget.

Sample of filling out the 3-NDFL declaration for 2016 for a tax deduction for education

Example description: In 2016, Ivanov I.I. paid for the child’s education at school for a total of 40 thousand rubles. In the same year Ivanov I.I. worked at Tulip LLC, where his annual income amounted to 1 million rubles. (a total of 130 thousand rubles of income tax was paid). Based on the results of the declaration, Ivanov I.I. 5,200 rubles must be returned from the budget.

Sample of filling out the 3-NDFL declaration for 2016 for a tax deduction for treatment

Example description: In 2016, Ivanov I.I. I paid 100 thousand rubles for my treatment at the dental office. In the same year Ivanov I.I. worked at Tulip LLC, where his annual income amounted to 1 million rubles. (a total of 130 thousand rubles of income tax was paid). Based on the results of the tax return, Ivanov I.I. 13,000 rubles must be returned from the budget.

Sample of filling out the 3-NDFL declaration for 2015 when selling an apartment

Example description: In 2015, Sidorov S.S. sold an apartment that he owned for less than three years for 3 million rubles. At the same time, Sidorov S.S. there were documents confirming the purchase of an apartment for 1.5 million rubles. Based on the results of the declaration, Sidorov S.S. must pay income tax in the amount of (3 million rubles – 1.5 million rubles) x 13% = 195 thousand rubles.

Sample of filling out the 3-NDFL declaration for 2015 when selling a car

Example description: In 2015, Sidorov S.S. sold the car, which I owned for less than three years, for 250 thousand rubles. The income from the sale of the car was fully covered by the standard deduction (the maximum amount for non-residential property is 250 thousand rubles). Accordingly, according to the results of the declaration for 2015, Sidorov S.S. does not have to pay additional income tax.

Sample of filling out the 3-NDFL declaration for 2015 for a tax deduction when buying an apartment

Example description: In 2015, Sidorov S.S. bought an apartment worth 4 million rubles. into a mortgage (in the same year he paid 400 thousand rubles in interest on the mortgage). Also in 2015, Sidorov S.S. worked at Landysh LLC, where his annual income amounted to 3 million rubles. (390 thousand rubles of income tax were paid). Based on the results of the declaration, Sidorov S.S. must be returned from the budget (2 million rubles + 400 thousand rubles) x 13% = 312 thousand rubles.

Sample of filling out the 3-NDFL declaration for 2015 for a tax deduction for education

Example description: In 2015, Sidorov S.S. paid for my university education in the amount of 100 thousand rubles. In the same year, Sidorov S.S. worked at Landysh LLC, where his annual income amounted to 1 million rubles. (a total of 130 thousand rubles of income tax was paid). Based on the results of the declaration, Sidorov S.S. 13,000 rubles must be returned from the budget.

Sample of filling out the 3-NDFL declaration for 2015 for a tax deduction for treatment

Example description: In 2015, Sidorov S.S. paid for an operation related to expensive types of treatment for his wife in the amount of 300 thousand rubles. In the same year, Sidorov S.S. worked at Landysh LLC, where his annual income amounted to 1 million rubles. (a total of 130 thousand rubles of income tax was paid). Based on the results of the tax return, S.S. Sidorov must be returned 300 thousand rubles from the budget. x 13% = 39 thousand rubles.

Sample of filling out the 3-NDFL declaration for 2014 when selling an apartment

Example description: In 2014 Petrov P.P. inherited an apartment and sold it for 2 million rubles. Accordingly, according to the results of the declaration, Petrov P.P. must pay income tax in the amount of (2 million rubles – 1 million rubles (standard deduction)) x 13% = 130 thousand rubles.

Sample of filling out the 3-NDFL declaration for 2014 when selling a car

Example description: In 2014 Petrov P.P. sold the car, which I owned for less than three years, for 720 thousand rubles. Petrov P.P. there were documents confirming the purchase of the car for 800 thousand rubles. Accordingly, according to the results of the declaration, Petrov P.P. does not have to pay tax on income from the sale of a car.

Sample of filling out the 3-NDFL declaration for 2014 for a tax deduction when buying an apartment

Example description: In 2014 Petrov P.P. bought an apartment worth 2 million rubles. In the same year Petrov P.P. worked at Romashka LLC, where his annual income amounted to 1 million rubles. (130 thousand rubles of income tax were paid). Based on the results of the declaration, Petrov P.P. 130 thousand rubles must be returned from the budget. and the remainder of the deduction in the amount of 1 million rubles. (130 thousand rubles to be returned) will be transferred to the following years.

Sample of filling out the 3-NDFL declaration for 2014 for a tax deduction for education

Example description: In 2014 Petrov P.P. paid for my daughter’s university education for a total of 140 thousand rubles. In the same year Petrov P.P. worked at Romashka LLC, where his annual income amounted to 1 million rubles. (a total of 130 thousand rubles of income tax was paid). Based on the results of the declaration, Petrov P.P. 6,500 rubles must be returned from the budget. (maximum refund for education of one child).

Sample of filling out the 3-NDFL declaration for 2014 for a tax deduction for treatment

Example description: In 2014 Petrov P.P. paid for his mother’s treatment in the amount of 60 thousand rubles. In the same year Petrov P.P. worked at Romashka LLC, where his annual income amounted to 1 million rubles. (a total of 130 thousand rubles of income tax was paid). Based on the results of the tax return, Petrov P.P. 7800 rubles must be returned from the budget.