Individual entrepreneur is on the general taxation system. What taxes does the individual entrepreneur pay on the basis? Accounting

By understanding what reports an individual entrepreneur submits under the general taxation system in 2019, businessmen are personally convinced of the advantages of the chosen system. Unlike the simplified tax system, no restrictions are imposed on UTII, which reduces the level of bureaucratic red tape. In order to submit information to the tax authorities in a timely manner, an entrepreneur must know the deadlines, types of reports, and cases when a particular document needs to be submitted.

BASIC: system features

OSNO or the general taxation system is quite complex, especially in terms of reporting. However, it allows an entrepreneur to work without fear of the restrictions that Russian legislation imposes on other taxation options:

- by number of employees;

- by annual income;

- by the number of activities that a businessman is engaged in.

Since the development of an enterprise may involve various areas of activity, in some cases OSNO can be combined with various options for simplified systems. For organizations, it is possible to combine the general system with UTII. For individual entrepreneurs, you can use OSNO in combination with a patent and a single tax.

When is OSNO beneficial for an individual entrepreneur?

Reporting on a common system is more difficult than on simplified analogues. However, in the following cases, it is beneficial for an individual entrepreneur to remain on OSNO:

- With zero income, there is no payment of income tax, unlike simplified systems. However, one should not forget that reporting for individual entrepreneurs on OSNO with zero activity must be submitted in a timely manner.

- When a businessman is a VAT payer, cooperates with enterprises that are also payers of this tax, or imports products from abroad. In this case, it becomes possible to reduce tax costs, acquire the image of a profitable partner, and increase the competitiveness of your business.

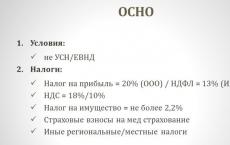

Taxes for individual entrepreneurs on OSNO

Taxation on the general system is quite complex. To successfully report for the past period, you must pay the following taxes:

- Personal income tax - in the amount of 13% of profits;

- VAT, the rate of which, depending on the products sold, can be 0%, 10% or 18%;

- Property tax - up to 2%.

When starting its activities, an individual entrepreneur is on the general taxation system, unless he has declared his desire to switch to a simplified version. If in the process of work an individual entrepreneur chose a simplified system, then To switch to OSNO, just contact the tax office.

When an individual entrepreneur hires more workers than provided for by the regulations and receives greater profits, he is automatically transferred to OSNO.

All taxes paid by entrepreneurs are subject to reporting and must be promptly transferred to the appropriate funds. An individual entrepreneur operating on a basic basis is required to maintain primary documentation. It is the basis for submitted declarations, certificates, and forms. This is a book of income and expenses, which reflects the income and expenses of a businessman related to business activities. Subsequently, they affect the amount of deductions when calculating VAT.

Reports for individual entrepreneurs without employees

What reports should individual entrepreneurs submit to OSNO without employees in 2019:

| Document type | Features of its filling |

|---|---|

| VAT | The VAT return is submitted every quarter. Please note that the report is accepted exclusively in electronic form until the 25th, and Tax payment must be made every month. |

| Personal income tax | An entrepreneur fills out Form 3-NDFL once a year. The tax itself is calculated on the basis of income from business activities and income of an individual, if such does not relate to the activities of an individual entrepreneur. When studying what kind of reporting an individual entrepreneur submits to OSNO without employees in 2019, please note that The 13% personal income tax rate is provided only for residents. For non-residents without employees, the tax rate is 30%. |

| Property tax | Paid in the amount of 0.1-2% of the value of fixed assets, if any. This expense item cannot be optimized, since assets are assessed by specialists and their cadastral price rarely differs from the real market price. However, this indicator reduces the amount of net profit of the enterprise, and, accordingly, personal income tax. |

Features of submitting zero reporting

If during the reporting period the individual entrepreneur did not conduct business or receive any income, he is required to submit a zero report. Such a requirement is made because after state registration a businessman becomes an entity that is obliged to constantly pay taxes.

If the zero report was not provided in a timely manner, the entrepreneur will be fined for violation of record keeping. Since the zero document is a full-fledged document, it is worth approaching its execution with all responsibility.

What to submit if an individual entrepreneur has zero reporting on OSNO in 2019

If an individual entrepreneur operates without employees, the package of documents for zero reporting will not differ from the standard one. It must include a VAT declaration, a completed form 3-NDFL and a report for ROSSTAT.

When an individual entrepreneur has hired employees, it will be necessary to submit a report quarterly. The package of documents will include a VAT declaration, a 4-FSS certificate, a DAM report, and personification. Despite the fact that there is no profit, the enterprise continues to operate, and will have to submit a report to ROSSTAT annually.

Report submission deadlines

The deadline for submitting documents does not depend on whether you have a large income or no profit at all. You have to keep records the same way, and even the first day of late reporting will be a good reason to get a fine:

- Papers are submitted to the Pension Fund by the 15th, one month after the reporting period.

- You will also have to visit the FSS monthly until the 15th.

- 3-NDFL must be submitted annually by the end of April.

- The VAT declaration is submitted monthly until the 20th.

- ROSSTAT expects the report until January 20.

- It is better to resolve the issue with the Pension Fund before the 15th of the next month after the end of the reporting quarter.

Methods for submitting reports

Documents that relate to any type of report can be transmitted in paper or electronic form. If an entrepreneur chooses to submit reports remotely, he will have to receive electronic signature.

When planning to submit reports electronically, please note that they must be accepted by a specialist by the specified deadline. If the document is rejected, the businessman will face a fine, even if there was no profit in the reporting period. The amounts of penalties imposed on an entrepreneur start from 1000 rubles.

Since reporting for individual entrepreneurs working on OSNO is quite complex, most entrepreneurs prefer to hire professionals to keep records, generate documents, and submit them in a timely manner.

When is OSNO applied for individual entrepreneurs?

If, after, within five days, an individual entrepreneur has not submitted an application to the Federal Tax Service to apply the simplified tax system or UTII, then he is obliged to apply the general taxation system.

The second case of using OSNO for individual entrepreneurs is cooperation with buyers who apply value added tax (VAT). When completing a transaction, the entrepreneur issues an invoice to the counterparty with allocated VAT, which allows the buyer to reduce his calculated tax.

Accounting for individual entrepreneurs on OSNO

An individual entrepreneur is exempt from accounting in full, but all transactions performed are required to be recorded in the individual entrepreneur’s book of income and expenses on OSNO. The CD&R form was approved by order of the Ministry of Finance of the Russian Federation and the MNV of the Russian Federation No. 86n/BG-3-04/430 dated August 13, 2002.

The book of income and expenses reflects the property status of the entrepreneur and the results of his activities for the tax period. The data in this book is used to calculate personal income tax.

Due to the fact that individual entrepreneurs on OSNO calculate and pay VAT, they keep a purchase book and a sales book, and all received and issued invoices are recorded in the registration journal.

Individual entrepreneurs who employ employees must maintain personnel records and payroll records.

Individual entrepreneur taxes on OSNO

The list of individual entrepreneur taxes on OSNO is small:

- Personal income tax of 13%;

- Value added tax of 18% on income received;

- Insurance contributions to extra-budgetary funds “for yourself” and for employees;

- Other local taxes for individual entrepreneurs (transport, land), if the property is used in business activities.

Individual entrepreneur reporting on OSNO

- VAT reporting is provided by the “Value Added Tax Tax Return”. It is submitted at the end of the quarter, by the 20th of the next month.

- The reporting document for personal income tax for individual entrepreneurs is the declaration of form 3-NDFL. It is submitted to the Federal Tax Service once a year by April 30, and the tax for the previous year is paid by July 15 of the following year.

- It is necessary to annually submit to the Federal Tax Service information on employee income, personal income tax certificate 2, by April 1 of the following year.

- Information on the average number of employees is submitted to the tax office once a year before January 20 of the following year.

- pays based on the cost of the insurance year. Contributions can be paid quarterly or once a year. Submission of the RSV-2 form is no longer required in 2017.

- Individual entrepreneurs calculate and pay insurance premiums to extra-budgetary funds for their employees monthly until the 15th of the next month. Form 4-FSS is submitted to the social insurance fund no later than the 15th day of the month following the reporting month.

More about the features of OSNO in this video:

Tax deduction for personal income tax for individual entrepreneurs on OSNO

Individual entrepreneurs have the right to receive a personal income tax deduction for the amount of expenses incurred, supported by documents. If the expenses are not confirmed, then you can apply a professional tax deduction in the amount of 20% of the entrepreneur’s income.

The taxpayer himself determines the composition of expenses; they also include the paid amounts of taxes under the law (except for personal income tax), insurance contributions to extra-budgetary funds, and state duties related to professional activities.

If you found this article useful, don't forget to leave a comment and tell your friends on social networks. And follow ours - there is a lot of interesting things ahead! Thank you.

Almost everyone knows the meaning of the abbreviation “VAT”, but only individual entrepreneurs know what the abbreviation “OSNO” can mean.

What taxes apply to OSNO

The general tax system (OSNO) includes several taxes. It is characterized by difficulty in handling and strict financial reporting.

If representatives of small and medium-sized businesses chose OSNO, then there were serious reasons for this:

- It is preferable for large companies to work under this regime with their counterparties;

- in this scheme there is no limit on profits and the number of employees;

- not all individual entrepreneurs can use a different tax system according to the law.

When is VAT paid?

OSNO is the only tax regime where it is required to pay VAT. The tax basis for VAT will be the price of the product or service that was sold.

OSNO is the only tax regime where it is required to pay VAT. The tax basis for VAT will be the price of the product or service that was sold.

Object of taxation

The objects of such taxation include:

The objects of such taxation include:

- goods and services sold;

- actions to transfer property rights;

- transferred goods and services, carrying out construction and installation work for their needs;

- import of products into the territory of the Russian Federation.

The tax is added to the cost of the product or service.

VAT rates

VAT has different rates regulated by the Tax Code of Russia.

VAT has different rates regulated by the Tax Code of Russia.

They are divided into types:

- The general rate for everyone is 18%.

- Preferential rate, the value of which is 10%.

It has been reduced for businesses in the trade of certain types of goods:

- food;

- children's, medical, agricultural, book products;

- logistics services.

Work on VAT

The activity scheme for this tax is as follows: When carrying out a transaction, the seller presents the individual entrepreneur with an invoice, in which VAT is indicated as a separate line. In the future, the entrepreneur, when selling the product, takes it into account in the cost for buyers.

The activity scheme for this tax is as follows: When carrying out a transaction, the seller presents the individual entrepreneur with an invoice, in which VAT is indicated as a separate line. In the future, the entrepreneur, when selling the product, takes it into account in the cost for buyers.

- input value added tax - an amount included in the price of a product or service purchased from a supplier and paid to the budget in a certain reporting period;

- outgoing value added tax means the amount of tax included in the price of goods and services sold by a businessman and paid for by consumers.

How to submit reports

The report is submitted quarterly. Tax payment must be made by the 25th day of the following month after the end of the reporting quarter.

The report is submitted quarterly. Tax payment must be made by the 25th day of the following month after the end of the reporting quarter.

The declaration to the tax service is submitted in electronic form.

Important! Failure to report will result in penalties. Failure to submit the report on time will result in suspension of bank accounts.

To calculate VAT for individual entrepreneurs on OSNO, reporting must be strictly observed from the very beginning. Invoices are entered into a special book of sales and purchases, since the result of the final VAT calculation is compiled from it.

Who is exempt from VAT

According to Article 145 of the Tax Code, entrepreneurs whose organization's revenue for the previous quarter amounted to less than 2 million rubles are exempt from payment.

According to Article 145 of the Tax Code, entrepreneurs whose organization's revenue for the previous quarter amounted to less than 2 million rubles are exempt from payment.

Attention! This privilege does not apply to businesses related to the sale of excise products (alcohol, tobacco products, fuel, some types of cars).

How to get a benefit

You can officially be exempt from VAT by contacting the tax authorities at your place of registration.

You can officially be exempt from VAT by contacting the tax authorities at your place of registration.

For this purpose, you must fill out a notification, including an extract from the income and expenses book and a copy of the invoice book.

The request must be submitted before the 20th day of the month from which the individual entrepreneur wants to receive tax exemption. This right is confirmed once a year.

Important! If the situation changes and revenue increases, the entrepreneur must independently inform the tax authority about this in order to avoid fines and penalties.

A similar situation applies to cases where excise products were sold during the reporting period.

About tax deductions

To reduce the VAT amount, you should use the tax deduction option.

To reduce the VAT amount, you should use the tax deduction option.

To use it, you must fulfill certain requirements:

- goods and services are acquired for the purpose of carrying out production activities or other taxable operations, or for resale;

- products purchased by the enterprise must be listed on the balance sheet;

- the organization has documents confirming the right to deduct. Typically, these include invoices issued by the supplier.

VAT is recorded as a separate column in all accounting documents.

In some cases, it is more profitable for individual entrepreneurs to run their business using OSNO. This system simplifies trading and cooperation with large companies.

Watch a video about the general tax system

On the same topic

Entrepreneurs, when choosing a tax system that is convenient for them, weigh all the pros and cons.

The general tax regime - OSNO - has certain disadvantages and difficulties. But for a number of categories of taxpayers it is beneficial.

Let us consider the features of this taxation system step by step and in detail. Let's find out the differences in this system, figure out what taxes an individual entrepreneur must pay on OSNO, what reports he must submit.

What is OSNO and when is this mode beneficial?

OSNO - general taxation system. This regime is quite complex, especially in terms of the volume of reporting. And the tax burden on it is considerable. More often, individual entrepreneurs choose the simplified system, the simplified tax system. Especially at the start of business. But a number of categories of taxpayers benefit from this particular tax regime.

OSNO is sometimes called the main taxation system, using the abbreviation OSN. But the essence does not change. The general taxation system for individual entrepreneurs is the amount, the totality of taxes. Its main advantage: the absence of any restrictions. There are no obstacles in terms of the number of employees, the variety of activities or the amount of income received.

Of course, entrepreneurial activity may involve different areas, specializations, and, accordingly, taxation systems. How can tax regimes be combined? In relation to organizations: OSNO is compatible only with UTII; in the case of individual entrepreneurs, combinations with the Patent Taxation System and UTII are possible.

In what cases is IP on OSNO more profitable than on special tax regimes?

When your consumers and partners for the most part also use this system and pay VAT. In this case, you help each other in terms of reducing the VAT amount. You yourself reduce the VAT paid by the amounts paid for the same tax by performers and suppliers of components. Buyers and partners, in turn, also reduce their VAT by deducting the tax you paid. You acquire the image of a profitable business ally, becoming more competitive in the market in the category of OSNO taxpayers.

For individual entrepreneurs who regularly import goods into Russia, VAT is required to be paid on imported goods. These amounts can be returned as a deduction if the entrepreneur uses OSNO.

Individual entrepreneur taxes on OSNO in 2019: what and how?

What taxes will individual entrepreneurs have to pay on OSNO in 2019? For comparison, here are the taxes of organizations in the format of JSC and LLC, these are:

- corporate income tax at a rate of 20%. This is the main rate, and there are also special ones: from 0 to 30%.

- corporate property tax, amount - up to 2.2%.

- VAT with rates of 0%, 10%, 20%.

The following categories of taxes are provided for individual entrepreneurs:

- VAT at 0%, 10%, 20%.

- Personal income tax, if in the reporting year the entrepreneur was a resident of the Russian Federation, 13%.

- 2 percent property tax for individuals.

What is the mechanism for the transition to a common taxation system for individual entrepreneurs? This is the “trick” that you don’t have to make any special efforts. There is no need to run to the tax office if you have not chosen a special type of taxation: UTII, patent, Unified Agricultural Tax, simplified tax system. It’s just that at the moment of registering an organization or individual entrepreneur as an individual, you will automatically be placed in this regime.

The same is true when leaving other taxation systems. You can switch from the previously chosen format deliberately, but there is another option - if the prescribed requirements are violated. Let's say that an individual entrepreneur has exceeded the income level or hired more employees than allowed by this algorithm. And then the local tax authority will independently make the transfer to OSNO.

Voluntary transfer of an individual entrepreneur to OSNO from other taxation systems is possible by submitting a corresponding notification to the Federal Tax Service before January 15 of the year in which it is planned to abandon special taxation systems. It does not consist in the fact that you submit a special notification for the application of OSNO, but in the fact that you submit a notification to deregister you as a taxpayer of the simplified tax system, UTII or Unified Agricultural Tax. The tax office does not impose any obstacles or restrictions in this case.

Corporate income tax

Now let's take a closer look at individual types of taxes. The profit of an organization is the difference obtained by subtracting expenses incurred from income earned. You will have to take into account different types of income, and in the individual entrepreneur’s reporting on OSNO it will be necessary to document them. This:

Basic income received from the sale of goods and services, as well as rights to property;

Expenses are taken into account in the same way. The difference is that the tax inspectorate will check their authenticity especially carefully. This is quite logical: the larger the expenditure part, the less the final amount of profit will be, and therefore this tax. Therefore, stock up on invoices, delivery notes, and other payment documents that record the expenses of the individual entrepreneur.

They, too, like income, are divided into 2 types:

Costs of production and sales, including costs of materials, raw materials, wages, etc.;

The non-sales group includes expenses for maintaining part of the property that is leased; interest on loan obligations, etc.

Article 284 of the Tax Code of the Russian Federation describes in detail the rates of this tax for individual entrepreneurs engaged in specific types of activities and having different sources of income. This figure ranges from 0 to 30%; the basic corporate income tax rate is 20%.

Property tax

For organizations that have chosen OSNO, the object of taxation becomes movable and immovable property, which is recorded on the organization’s balance sheet as fixed assets. There is an exception for movable property placed on the balance sheet after January 1, 2013: it is generally exempt from tax. For the rest of the property, this tax is paid at a rate of no higher than 2.2% of its average annual value.

The same type of tax for individual entrepreneurs on OSNO in 2019 is calculated on a general basis, that is, as an individual, at a rate of up to 2% of the inventory value of real estate. The object of taxation here is all the property of individual entrepreneurs that is used in business activities.

Property tax is paid no later than November 15 of the year following the reporting year. The basis is tax notifications sent by the Federal Tax Service annually. Declarations for this tax from individual entrepreneurs are not required.

Value added tax (VAT)

VAT is paid both when importing foreign goods into our territory and when selling services and goods within the country. If a number of conditions are met, the rate can be 10% or even zero.

The usual amount is 20%, but it can be reduced by the amount of tax deductions in two cases. First: when importing imported goods into the territory of the Russian Federation. The second deduction option can be provided by suppliers (counterparties). This will be the amount of VAT they paid, but only if they also apply the OSNO regime.

Such deductions are otherwise called “VAT offset”, but they can only be made if you have an invoice, and sometimes some other documents. In addition, work, goods or services must be capitalized (put on the balance sheet), that is, accepted for accounting.

Calculating VAT is a complex procedure, in some cases it has subtle nuances that are necessary for the work of specialists. Here we present only the basic formula for its calculation.

What data and actions will be required?

Find VAT on the total amount of income, that is, accrued. We multiply the total income by 20 and divide the result by 120.

The next step: we calculate VAT for offset (deductions). Expenses * 20 / 120.

Last action: VAT payable = VAT accrual - VAT offset.

Example. The individual entrepreneur bought boots for 600 rubles. The supplier must pay VAT = 600 rubles for this product. * 20 / 120 = 100 rub.

Having sold the same shoes for 1,000 rubles, the individual entrepreneur paid the state tax on this transaction = 1,000 rubles. * 20 / 120 = 166.67 rub.

We calculate the final VAT payable = 166.67 rubles. — 100 rub. = 66.67 rub.

Since 2015, VAT payments have been made quarterly, but divided into equal monthly shares, no later than the 25th day of each month of the subsequent quarter.

Let's say for the 2nd quarter of 2019 you will need to pay VAT of 450 rubles. We divide them into 3 equal parts of 150 rubles each. and pay on time: until July 25; until August 25; no later than September 25.

We remind you that starting from January 1, 2017, explanations for electronic VAT returns are submitted to the Federal Tax Service only in electronic form via telecommunication channels (TCS).

Personal income tax

Personal income tax is paid by an entrepreneur on the income of his activities, as well as by an individual on those incomes that are not included in business activities.

An individual entrepreneur has the right to reduce income by the amount of professional deductions, but, we remind you, only by expenses (deductions) that are documented. Calculations are made using the formula: personal income tax = (income - deductions) * 13%.

The number 13% here is the tax rate for individual entrepreneurs who are residents of the Russian Federation in the reporting year. To be recognized as such, an individual must actually be on the territory of the Russian Federation for at least 183 calendar days for the next 12 consecutive months.

For those who are not residents of the Russian Federation, the personal income tax rate is 30%.

What reports does an individual entrepreneur submit to OSNO: VAT declaration

All of the above taxes are not only paid, but are also subject to reporting by the entrepreneur. This is the answer to the question of what reports an individual entrepreneur submits to OSNO.

Since 2014, VAT returns can only be submitted electronically. Since 2015, this document has been submitted to the tax office quarterly, but no later than the 25th day of the month following the reporting quarter. Specifically, first quarter returns must be filed no later than April 25; for the 2nd to July 25; for the 3rd quarter - no later than October 25; for the 4th - until January 25. These return submission dates remain valid in 2019.

Regular maintenance of sales and purchase records is also required. The first contains invoices and other documents needed for the sale of goods and services in situations where VAT calculations are required. Invoices confirming payment of VAT are entered into the VAT purchase journal. This is necessary to determine the amount of deductions in the future.

The third important reporting document of the individual entrepreneur: KUDiR - book of income and expenses. It is not needed for organizations.

Corporate income tax reporting

There are three ways to pay advance income tax payments:

1. Based on the results of the 1st quarter, half a year, 9 months plus advance payments within each quarter on a monthly basis. Payments made monthly must be made no later than the 28th day of the month following the reporting month. Quarterly - no later than the 28th day of the month following the expired quarter.

An important nuance. The average amount of income for the previous 4 consecutive quarters is calculated based on the results of each reporting quarter. If this amount is less than 10 million rubles (for each quarter), then the organization will not need to make advance payments every month (there is no need to notify the tax office about this).

2. Based on the results of the 1st quarter, half a year, 9 months, but without monthly advance payments. The method is valid for organizations with income for the last 4 quarters of less than 10 million rubles. for each quarter (on average), as well as non-profit organizations, budgetary, autonomous institutions that do not have income from sales, and a number of other categories.

3. At the end of each month, according to the profit actually received in it. Also no later than the 28th of the next month. But you can switch to this option only from the beginning of the next year. And the tax authority should be notified about this the day before, no later than December 31 of the previous year.

The tax at the end of the year for all these methods is paid no later than March 28 of the year following the reporting year.

The individual entrepreneur's reporting document for OSNO in 2019 is the declaration. It is sent to the inspectorate every quarter; this will be a report for the first quarter, half a year, 9 months and a year. The filing deadlines are similar to those for advance payments: no later than the 28th day of the month following the reporting quarter (year).

If advance payments are calculated based on profits each month, then a monthly declaration will be required. Deadline: 28th of the next month.

Organizational property tax: payments and reporting

Advance payments and taxes are paid once a year, unless a different procedure is provided for by the laws of the constituent entities of the Russian Federation.

The declaration to the tax authority should be submitted based on the results of the 1st quarter, half year, 9 months and year. The annual report is submitted no later than March 30 of the following year. the remaining declarations are made on the 30th day of the month, which follows the reporting period. Which tax office is the declaration submitted to? At the location of each of the separate divisions with a separate balance sheet; according to the territoriality of each of the real estate objects, which is regulated by a separate procedure for calculating and paying tax.

Personal income tax. Tax reporting from individual entrepreneurs

Based on tax notifications, advance payments for personal income tax are made. The first - until July 15 of the current year, the 2nd - no later than October 15, the 3rd - until January 15 of the next year. At the end of the year, the personal income tax remaining after advance payments is paid until July 15 of the following year.

Before April 30 of the year following the reporting year (once a year), a declaration in form 3-NDFL is submitted. A declaration in form 4-NDFL (about estimated income) must be submitted within 5 days after the end of the month in which the first income was received. This document is required to simplify the calculation of advance personal income tax payments. It is needed not only for beginners, but also applies to those who stopped working for a while and then resumed work. Another reason is an increase or decrease in annual income by more than 50% compared to the previous year.

Change in the calculation of penalties, relevant in 2019 for LLCs

Another important change in 2017, still relevant in 2019, for LLCs concerns the calculation of penalties.

From 10/01/2017, LLC penalties will be calculated according to new rules, taking into account the number of calendar days of untimely fulfillment of obligations to pay taxes and contributions:

- for delay in fulfilling the obligation to pay taxes or insurance premiums for a period of up to 30 calendar days (inclusive) - penalties are calculated based on 1/300 of the refinancing rate in effect during the period of delay;

- for delay in fulfilling the obligation to pay taxes or insurance premiums for a period of more than 30 calendar days - penalties are calculated based on 1/300 of the refinancing rate valid for the period up to 30 calendar days (inclusive) of such delay, and 1/150 of the refinancing rate valid during the period , starting from the 31st calendar day of such delay.

Those. starting from the 31st day of late payment, the amount of the daily penalty doubles.

In addition to the above general taxes, when applying OSNO, it is also necessary to pay insurance premiums for employees and professional taxes and fees.

We will list them briefly, and you can get more detailed information on the corresponding pages of our website.

So, insurance premiums calculated based on employee income:

- for pension insurance - 22%;

- for health insurance - 5.1%;

- for insurance for temporary disability and in connection with maternity - 2.9%;

- from accidents and occupational diseases - from 0.2% to 8.5%, depending on the professional risk class. You can find out the tariff for a specific type of activity by following the link.

Professional taxes and fees include:

- fee for aquatic biological resources;

- fee for the use of wildlife objects;

- trade fee.

In this article you will learn:

- how an entrepreneur can keep records using the traditional general taxation system (hereinafter referred to as OSNO);

- how the income and expenses of a merchant on OSNO are taken into account;

- How to report to a businessman on OSNO on his activities.

Entrepreneurs use the traditional general taxation system for a reason.

The determining factors for choosing such a system are not only the businessman’s turnover, which may go beyond the limits of special tax regimes, but also the field of business in which the entrepreneur operates. Thus, in the B2b market, the competing value, all other things being equal, for the quality of a product (work, service) is the price value. Businessmen with a traditional taxation system determine the latter taking into account indirect tax (VAT). That is, a tax that is presented as part of the price to the buyer. A commercial buyer, under certain conditions, has the right to a guaranteed amount of deduction in the amount of the indirect tax (VAT) rate.

It is also beneficial for businessmen who work for export or use VAT exemption to use the traditional taxation system. The former, for example, use the same VAT deduction amount as a tax planning tool. And the latter (exempt from VAT) simply pay less tax on income (13%), compared to the simplified tax system at a rate of 15 percent. And the list of expenses that reduce the personal income tax base is expanded and determined according to the rules of Chapter 25 of the Tax Code of the Russian Federation (income tax). While on the simplified tax system the list of costs that reduce the base for the single tax is strictly regulated.

Rules for accounting for transactions of individual entrepreneurs using OSNO

Regardless of which system an entrepreneur uses, he is exempt from accounting if he keeps records of income and expenses in the manner prescribed by tax legislation. Such rules are established in Article 6 of Law No. 402-FZ On Accounting.

Entrepreneurs using the traditional taxation system keep records of income and expenses and business transactions according to the rules established back in 2002. Thus, during this period, Order No. 86n of the Ministry of Finance of Russia and the Ministry of Taxes of Russia No. BG-3-04/430 dated August 13, 2002 (with amendments and additions) was created and is still in force.

It is according to the rules of this document that a businessman keeps records of transactions in a special book of income and expenses.

On a note! The author of the article is often asked questions regarding the need for an Order on the accounting policies of an entrepreneur on OSNO. Here the Law and Chapter 23 of the Tax Code of the Russian Federation do not directly indicate the presence of such a document. However, we should not forget that merchants on the general taxation system are VAT payers. And if an entrepreneur carries out both taxable and tax-exempt transactions, he must keep separate records of them, the methodology of which is prescribed in the accounting policy without fail.

Are there no such operations? Then there is no need to create an accounting policy. But it should be noted that traditionally businessmen are often asked for such a document during tax audits. Therefore, having an order on accounting policies will not be superfluous.

So, the book of income and expenses is kept in the form established by Order of the Ministry of Finance of Russia No. 86n and the Ministry of Taxes of Russia No. BG-3-04/430. Paragraph 7 of this document directly states that the merchant has the right to independently develop the form of a book for recording income and expenses. However, such an independently developed document should be agreed upon with the tax authority at the place of registration.

The book of income and expenses is kept in one copy. There is no point in duplicating data in similar documents and other tax registers. But starting from the new tax period (year), a new book must be opened.

By the way, this rule also applies if an individual entrepreneur conducts several types of activities at OSNO. That is, all transactions are reflected in only one book.

The book can be kept in an automated program - electronically or in paper form. Although it is now difficult to imagine a non-automated process of business transactions of individual entrepreneurs on OSNO with VAT calculation.

If a merchant keeps an accounting book in electronic form, then at the end of the year it is printed, numbered, and stapled, indicating the number of pages on the last sheet. Such a book must be certified by the tax authority with a seal.

Don't keep a book? Then you are violating tax laws. Such an offense is recognized as a gross violation of the rules for accounting for income, expenses and the object of taxation. The fine for such an offense is provided for in Article 120 of the Tax Code of the Russian Federation.

All entries in the book of income and expenses should be made in chronological order. This must be done on the basis of primary documents. Based on primary documents, business transactions and the corresponding income and expenses are entered.

The procedure for accounting for income and expenses of individual entrepreneurs on OSNO in 2018

Accounting for individual entrepreneurs' income on OSNO in 2018

Merchants include in their income income from the sale of goods, works, services and property used in business activities.

Income is an economic benefit in cash or in kind that can be measured. This definition is given in the fundamental article 41 of the Tax Code of the Russian Federation.

It is important to know when income is recognized. At the moment, for individual entrepreneurs on the general taxation system, the legislation does not have a single approach to the moment at which a businessman generates income. It is traditionally accepted that income is generated on the date of receipt of funds - the cash method of recognition. By the way, the Russian Ministry of Finance exclusively adheres to this option for recognizing income in its numerous official explanations. This means that the businessman must include the advance received, for example, for the upcoming supply of goods (work, services) in the personal income tax base. Some Federal judges sided with Treasury officials ahead of the Supreme Court's opinion on the issue.

The Supreme Court is against such a one-sided interpretation of the provisions of the Law. Thus, in the ruling of the Supreme Court of the Russian Federation dated May 6, 2015 No. 308-KG15-2850, judges indicated the possibility of choice in the method of income recognition. With the accrual method, it is the fact of sale of goods (works, services) that is important. By the way, in the provisions of Article 208 of the Tax Code of the Russian Federation on the generation of income, we are talking about sales, and not about funds received.

In addition, businessmen determine income from commercial activities solely based on primary documents that are drawn up when making a transaction.

An entrepreneur can receive income not only in cash, but also in kind.

Thus, when receiving money, the amount of VAT that was presented to the counterparty - the buyer - is excluded from income. For example, if an individual entrepreneur sold a product at a price of 118 rubles, including VAT of 18 rubles, then upon receipt of the entire amount, only 100 rubles will be included in income. (118 − 18) rub.

When receiving income in kind, a different approach applies. Firstly, the date of receipt of such income is the day the goods (work, services) are received.

Secondly, income is determined in the amount of the market value of the benefit (asset) received. By the way, when receiving income in kind, do not forget about non-taxable transactions.

The list of income not subject to personal income tax is given in Article 217 of the Tax Code of the Russian Federation. Thus, when determining income received in kind as a gift, it is not necessary to take into account real estate, vehicles, shares, shares, shares received from family members or from close relatives as a gift, for example.

Attention! The author does not consider in the article the issue of the procedure for classifying individual operations of a citizen as entrepreneurial activity and the procedure for classifying such income for tax purposes in the presence of a valid certificate of registration of a person as an individual entrepreneur.

Accounting for individual entrepreneurs' expenses on OSNO in 2018

Business expenses form the amount of professional deduction by which a businessman reduces his income.

There are two mandatory conditions under which expenses can be taken into account as part of the professional deduction:

- Expenses must meet the requirements of Article 252 of the Tax Code of the Russian Federation (must be related to the extraction of income, be economically justified and documented). Moreover, according to official explanations, a merchant cannot recognize expenses if he has not yet received income;

- The expenses must be paid (repaid, closed) by the merchant.

At the same time, the composition of expenses that are included in the professional deduction is not strictly regulated. The provisions of the Tax Code of the Russian Federation state that a merchant can take into account as part of a professional deduction such expenses that are similar in composition to the list of expenses specified in Chapter 25 of the Tax Code of the Russian Federation. And as you know, the lists of costs regulated by Articles 264 and 265 of the Tax Code of the Russian Federation are open.

By the way, if a businessman cannot document expenses or primary documents were lost or damaged, then a professional tax deduction can be claimed in the amount of 20 percent of the total amount of income received. That is, such a deduction is guaranteed.

When calculating personal income tax, depreciation may be included in the professional deduction. Moreover, you can depreciate property that was acquired both before and after the citizen’s registration as a businessman. The main condition is that the property must be used in business activities.

Thus, depreciable property includes a citizen’s own property used in commercial activities with a useful life of 12 months. and costing more than 100 thousand rubles.

The author draws attention to the fact that property liability, property, property rights and obligations of a citizen are legally indivisible (Article 2, 23 of the Civil Code, letter of the Federal Tax Service of Russia dated October 27, 2004 No. 04-3-01/665, letter of the Federal Tax Service of Russia for Moscow dated September 24, 2012 No. 20-14/089723@). This means that if the property is involved in a business, the entrepreneur can use it for personal purposes without any restrictions.

Individual entrepreneur reporting on OSNO in 2018

An entrepreneur under the traditional taxation system reports personal income tax on business profits and turnover. For this purpose, two types of reports are provided.

1. Declaration in form 3-NDFL. The form and procedure for filling out the declaration were approved by order of the Federal Tax Service of Russia dated December 24, 2014 No. ММВ-7-11/671.

The last revision of the form occurred on 02/19/2018. Therefore, if 3-NDFL is submitted before 02/18/2018, then the declaration is submitted in the old form.

The new (modified) form is used from February 19, 2018 for all declarations submitted after the specified time.

The declaration is submitted in one copy. This must be done at the place of registration, that is, the merchant’s place of residence, no later than April 30 of the year following the reporting tax period. That is, the declaration for 2017 is submitted no later than April 30, 2018.

The business declaration includes:

- title page;

- Section 1 “Information on the amounts of tax subject to payment (addition) to the budget/refund from the budget”;

- Section 2 “Calculation of the tax base and the amount of tax on income taxed at the rate”;

- sheet B “Income received from business activities, advocacy and private practice.”

This declaration is submitted so that the inspection authorities can determine in advance the approximate amount of income from the entrepreneur for the year. approved by order of the Federal Tax Service of Russia dated December 27, 2010 No. ММВ-7-3/768.

The declaration in form 4-NDFL must be submitted annually. For existing merchants, a specific deadline for submitting this document is not established in the Legislation.

The tax authority indicates that the declaration in form 4-NDFL should be submitted at the same time as the income declaration in form 3-NDFL for the year.

The exact deadline is established only for newly registered entrepreneurs. Such merchants provide a declaration in form 4-NDFL within five working days after a month has passed from the date of receipt of the first income.

In addition to personal income tax, entrepreneurs applying the general taxation system submit. The declaration should be drawn up in the form approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Special reporting for entrepreneurs

In addition to reporting to the tax authority and funds, entrepreneurs must also prepare:

All businessmen must submit statistical information about their activities and depending on the type of activity. At the same time, the composition of such reports is very diverse. Therefore, the author of the article recommends contacting the Rosstat authority at the place of registration in advance and clarifying the reporting forms. By the way, uniform deadlines for submitting statistical reports are not directly stipulated by the Law. The deadlines are indicated on the statistical reporting forms themselves.